Interest in direct air capture (DAC) has exploded in the last few years. I myself was skeptical of it until recently, reckoning that carbon capture from industrial sources was more efficient. But advances in technology, financial incentives, and business models have changed the game for DAC, likely permanently.

To watch the full presentation at CERAWeek 2023, check out the video below.

The primary driver is demand among the hardest-to-abate sectors, like airlines. The falling cost of DAC technologies makes it an alluring alternative to otherwise pricey decarbonization pathways for these sectors. Pathways for DAC to reach $100 per ton now look feasible.

As DAC evolves from pilot stages to widespread deployment, leveraging it to reduce parts-per-million (ppm) of CO2 in the atmosphere suddenly becomes possible. This could serve as an important insurance policy if traditional levers of decarbonization do not advance quickly enough to keep warming within acceptable bounds.

A business model for removals

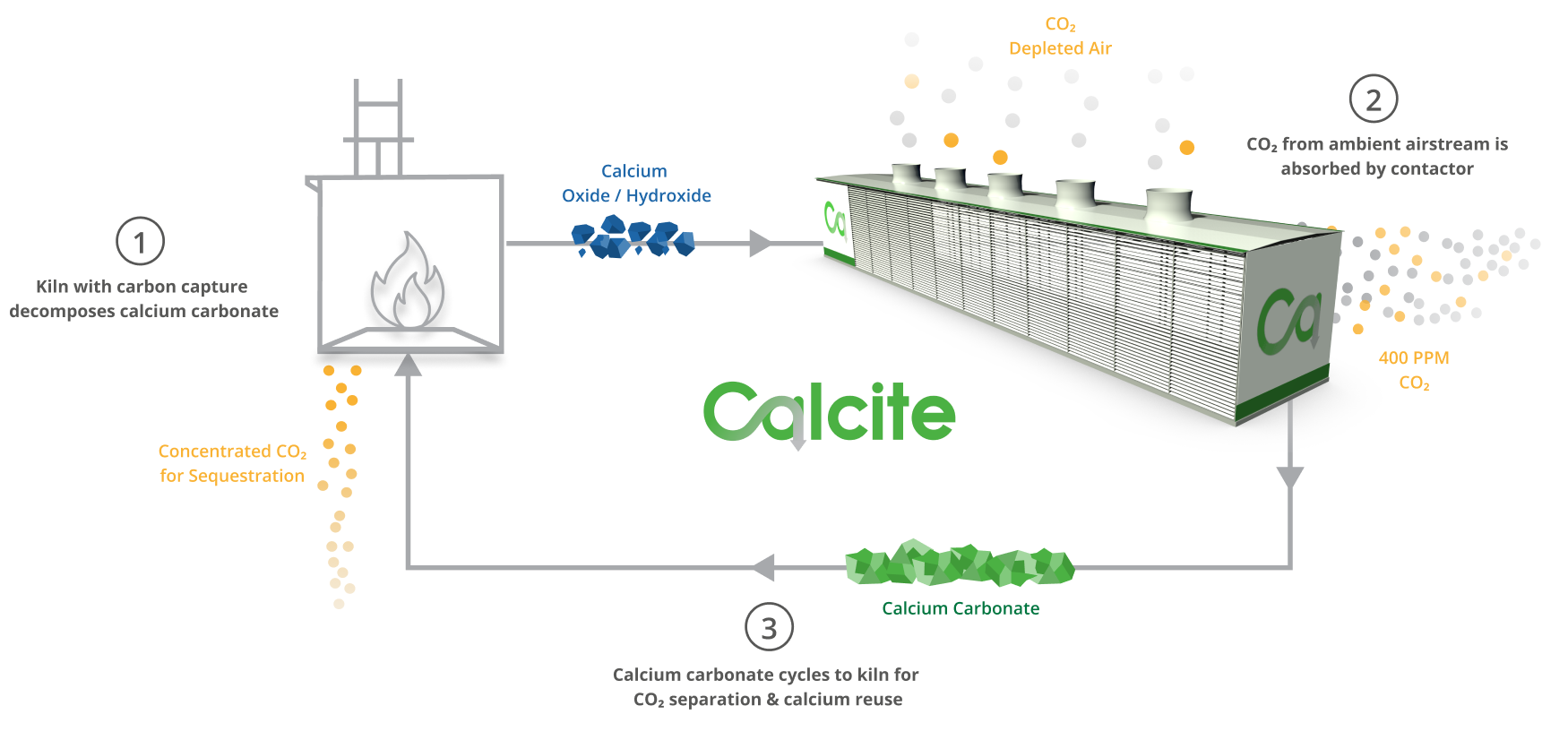

We believe that our proprietary DAC innovation, Calcite, will help universalize the technology as demand booms. Calcite is a mechanical process that utilizes basic chemistry and abundant materials, particularly limestone. In simple terms, large fans suck ambient air into a big facility and push the air across a sorbent, which separates out the CO2. It is then piped underground and stored.

8 Rivers invented Calcite in 2019 and we have been operating in “stealth mode” until last year, when XPRIZE and the Musk Foundation named Calcite a milestone winner in their carbon removal competition. The award cemented Calcite’s status as one of the leading carbon removal technologies in development today. It requires no complicated components or novel catalysts or materials—a level of simplicity that enables faster scale-up and progression to next-generation iterations. Calcite’s comparatively low cost reflects its accessibility: predictions are that it can achieve roughly $300 per ton for early plants, while dropping to less than $100 per ton in later iterations.

Progress in DAC technology has reached a stage that we can now seriously contemplate what it might look like at mass scale. The key burning question is, how do we monetize CO2 in a way that incentivizes the construction, operation and maintenance of these huge plants? What exactly are we selling when we sell DAC?

The simple answer is offset credits. These are certificates that large emitters pay to obtain, which prove that CO2 has been scrubbed from the atmosphere. Not every company can afford this outlay—they have to have the right combination of pressure to decarbonize, high cost of abatement, and high revenue. Technology companies, banks, airlines: these sectors fall in that sweet spot, to the extent that DAC is now becoming a compelling investment.

We then see DAC rapidly branching out from these niches due to a tax credit granted by the US government, known as 45Q. The recently passed Inflation Reduction Act increased the credit per ton of DAC to $180—a real game-changer. A cost structure of, say, $300 per ton is suddenly reduced by over half. 45Q applies to any project that begins construction before January 1, 2033, and for the first five years of the credit’s lifecycle, the Treasury Department will refund the cash directly from the beneficiary’s overall annual tax bill.

A blueprint for growth

A supercharged 45Q makes the US by far the best place in the world to do DAC. As a robust blueprint for this industry starts to come together, six factors will shape its future:

1. Land: We estimate that 200 acres are required for each million tons of CO2 captured. Akin to turbines on a wind farm, the fans in these facilities need abundant space between them. Trees, plants, greenhouses or even solar panels could fill these gaps, potentially.

2. Weather: This will be a key influence on the siting of DAC facilities. Performance of different DAC technologies varies depending on climate. Calcite, for one, prefers warm and humid air. Other chemistries need dry air.

3. Clean energy: DAC itself requires energy and powering the facilities with unabated energy sources defeats its purpose entirely. Ideally, DAC plants would run on energy sources that are extremely low to zero-emissions such as renewables or power plants with CCS. If natural gas is used to provide energy to the system, it’s important that upstream emissions such as methane leaks are minimized.

4. CO2 storage: 45Q applies for CO2 sequestered in what are known in the US as Class VI wells, which are underground storage sites specifically permitted for that application. Two major clusters of Class VI wells are housed in New Mexico and west Texas, and separately in the Gulf Coast area around Mississippi. More are coming online in places like Wyoming, North Dakota and Illinois. Siting, permitting, opening, and operating Class VI wells will be a vital component of DAC’s growth.

5. Ambient CO2: In the upper atmosphere, CO2 is fairly evenly distributed, but gathers in “clumps” closer to the ground. Concentrations of the gas in cities, for instance, could be as high as 800 ppm—four times higher than concentrations in rural areas. Data on ambient CO2 is patchy and will need to be strengthened as DAC expands.

6. Environmental justice: DAC needs to benefit the communities where it is sited; it must not perpetuate historical injustices of industrial pollution and economic inequality. On the contrary, DAC is well-positioned to be a growth driver, promoting jobs and commercial activity as clusters take shape around the country. This will require workforce training and upskilling, ensuring that DAC jobs draw from places that house plants. Building local goodwill promotes government and social acceptance, instigating a virtuous circle of further development. This promises a durable future for DAC as an integral part of the industrial landscape in the US.

The energy transition, and DAC especially, will be a tide that lifts virtually all boats. As rollout of clean power and retirement of polluting assets continues apace, DAC is poised to accelerate the transformation of the economy towards net zero, supporting emissions reductions to help meet the goal.

We feel strongly that Calcite has a big role to play, and we look forward to the next chapter in its dynamic and promising story.